Financial freedom

& security like never before

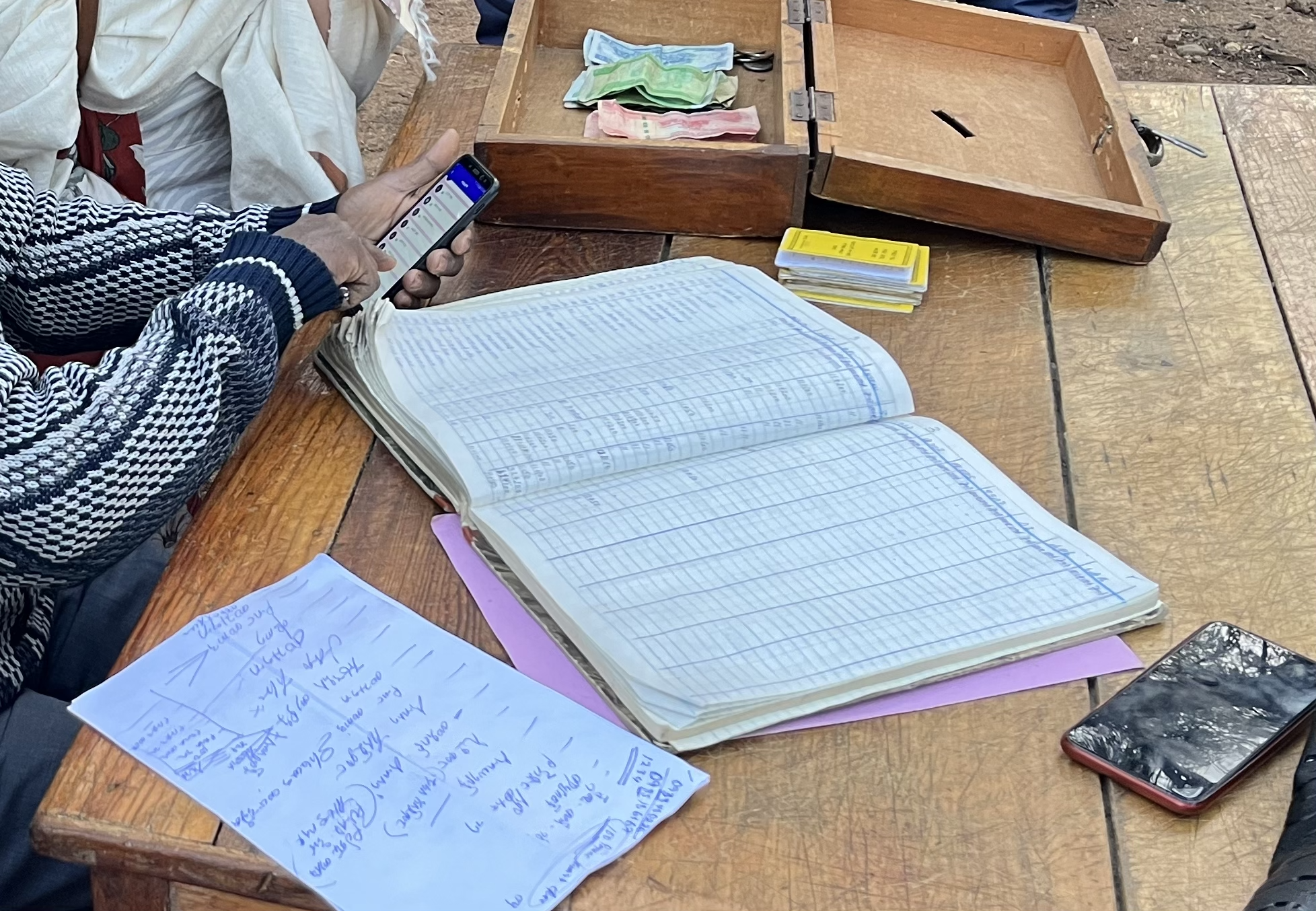

Futurise your group on a free digital

platform with affordable financial services.

Elevate your group

Move your record-keeping into a free app and get access to sustainable financial services catered to your group.

More

than

record keeping

Free digital

solution for your group

Accurate, quick and transparent record-keeping

Adaptable to different group types

Low in data cost

Only one smartphone needed per group

Insurance

made for your groups!

When your group uses Jamii.one, your members can protect themselves and their family better with uniquely affordable group insurance products. This way, your group also offers more value to the group members and the community!

Life insurance

Secure your life after losing a family member with the most affordable life insurance available in Ethiopia.

Last expense

Cushion against financial shocks after the loss of a loved one with our last expense services.

Hospital cash

Safeguard your family’s health and future with access to hospital cash services.

User Stories